Mon – Fri: 9AM – 5PM

This information is of a general nature only, and neither represents nor is intended to be specific advice on any particular matter. Infocus Securities Australia Pty Ltd.

Home » Financial Planning Services » Education Funding

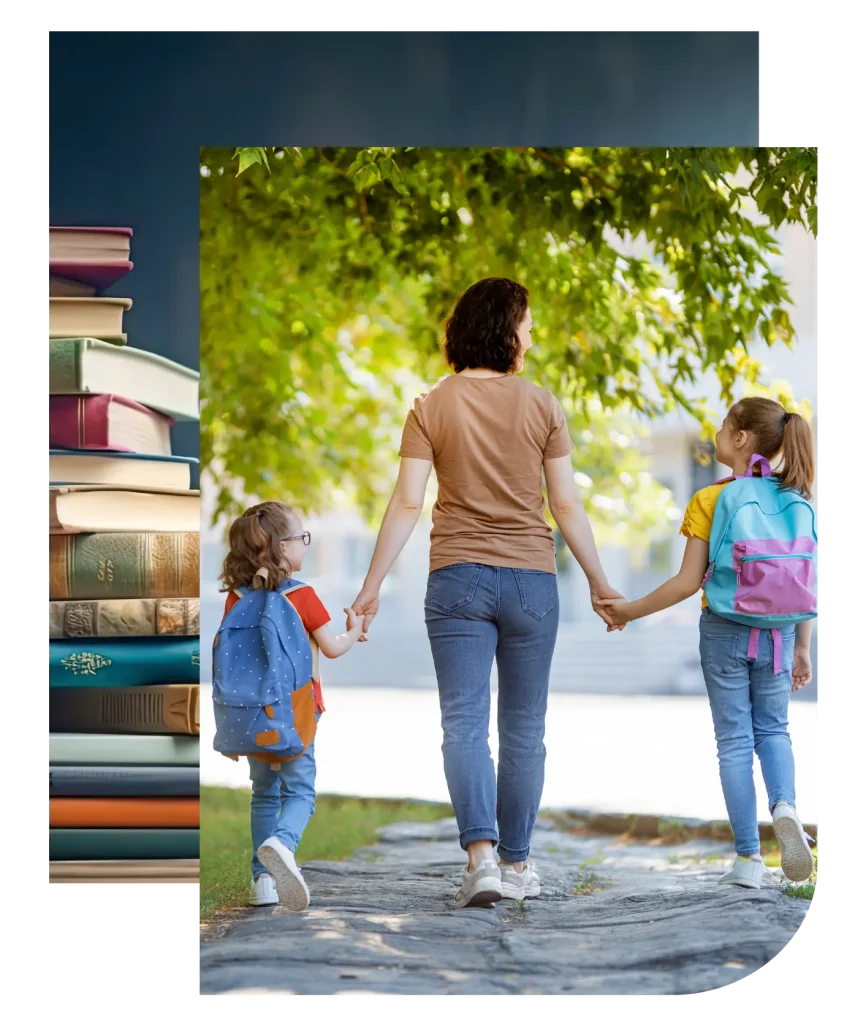

Planning for your child’s education isn’t just about putting money aside—it’s about giving them the best chance to succeed. At Lifestyle Led Wealth, we’re here to help you create an education funding strategy that takes the worry out of covering school costs. From education bonds and private school fees planning to building a comprehensive education cost plan, we’re here to support you every step of the way. Ready to start planning for your child’s future? Reach out to us today!

Paying tuition fees can add up quickly—but with the right planning, you can stay ahead of the curve.

The earlier you start planning education costs, the better prepared you’ll be to handle them. At Lifestyle Led Wealth, we’ll guide you through the best options to fit your family’s needs.

Our financial planner, Justin, is here to help you navigate the world of education funding. Whether you’re a parent or a grandparent, Justin will work with you to create a plan that ensures your children or grandchildren have the best educational opportunities.

With these smart investment options, we’ll help you fund your child’s education with confidence.

From primary school and high school to university, having a solid plan for education costs can make all the difference. We’ll work with you to figure out how to cover school expenses and tuition fees while keeping your overall financial goals in mind. Here’s how we can help:

Let’s chat about how we can make education funding simple and stress-free for you.

Education bonds are investment tools designed to help you save specifically for education expenses. They come with tax benefits, especially when used for paying tuition fees and other school-related costs, making them a smart choice for long-term savings.

Planning for private school fees means setting up a savings strategy to manage the higher costs of private education. Options like education investment bonds can help you save efficiently, ensuring you’re ready when the time comes to pay those fees.

Yes! Education bonds as gifts provide a meaningful contribution to a child’s future education. These bonds grow over time, offering a tax-efficient way to save and support future education costs.

Starting to plan for education costs involves taking a close look at your financial situation and creating a strategy to fund your child’s or grandchild’s education. This education cost planning might include using education bonds or investment bonds designed specifically for education, which can help cover expenses from private school fees to university costs.

At Lifestyle Led Wealth, we know that every family’s needs are different. That’s why we offer personalised education funding strategies that fit your financial goals and the educational aspirations of your children or grandchildren. From planning school costs to setting up a payment plan for tuition, we’re here to guide you every step of the way.

1300 068 453

justin@lifestyleledwealth.com.au

Level 4, 80 Market St

South Melbourne 3205